As we head toward the July 4th holiday, the news media continues to blare out a mixed bag of headlines. One day viral infections are surging and the market is plunging; the next day, things are perhaps getting better and the market is surging. The news media is always looking for a story to support the ever-present, breaking-news banners that run on television screens and websites.

Instead of trying to understand what’s going on by watching the news media, let’s dig a bit deeper and look for data that might provide a more reasoned assessment of what’s happening in the economy. I wrote last month about much better than expected employment data for the month of May. We’ll get another look at employment data for June tomorrow morning. While these data are a bit of a lag, it’s the best thing we have that tells us the extent to which the millions of Americans laid off and furloughed during March and April are going back to work.

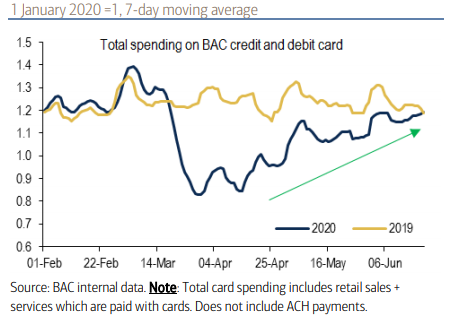

Beyond employment, data related to consumer spending is also showing signs of recovery. The chart below compares total spending on Bank of America credit and debit cards for 2019 and 2020. (The yellow line is a moving 7-day average for 2019; the blue line is 2020.)

Despite record levels of unemployment, the myriad governmental programs in place to support the economy (unemployment insurance, stimulus checks, the Payroll Protection Program, work from home, etc.) seem to be working as total spending in 2020 is back to 2019 levels. That is encouraging data!

While consumer spending is recovering, common sense tells us that spending patterns are not the same. Spending on travel, tourism, restaurants and entertainment is still suppressed. So where is this money being spent? There was an article in the Wall Street Journal a couple of weeks ago that answered this question. Leave it to Americans to find ways to spend their hard-earned dollars on things that make them happy. Here’s a link to that article.

Boats, Pools and Home Furnishings_ How the Lockdown Transformed Our Spending Habits – WSJ

We are continuing to monitor the progress of the re-opening of the economy and the markets. The S&P is still roughly 8.5% below the February highs, but up over 38% from the March low. We’ll see what the coming months bring us. If you have questions or would like to chat, please let me know.

Happy 4th of July!!