We know that the current political climate has many investors wondering how the US equity markets will perform under unified political leadership. We think it helps to understand the past in order to think about what the future holds. Today, the folks at Nasdaq Dorsey Wright, who provide us with their proprietary charting information, have written an article that we think you will find interesting, helpful, and perhaps calming. Let me know if you have questions. Also, don’t miss our introduction of new White Oak associates Luke Gerolimatos and Mia Eckl at the end of this email.

Sector Leadership in Unified Political Environments

The first full week of 2021 saw major domestic equity indices continue higher, as shown by the S&P 500 Index (SPX) posting its second straight week of gains at a return of 1.83% through Friday. This came after residents of Georgia completed a runoff election from November that resulted in the Democratic Party gaining two additional senate seats, which may effectively give the Democratic Party control of the Senate when factoring in the tie-breaking vote of Vice President-elect Harris. Combining these results with the November election results indicates that the Democratic Party may be in control of both houses of Congress and the White House for the first time since 2009. The 117th Congress that began in 2021 marks the 24th occurrence of a single party controlling both Congress and the White House since 1926. Interestingly enough, this is equal to the number of times we have seen a division of power between the White House, Senate, or House of Representatives. With domestic equity markets starting the year at or near all-time highs, there has been no shortage of speculation around how we should expect markets to perform with this new political environment.

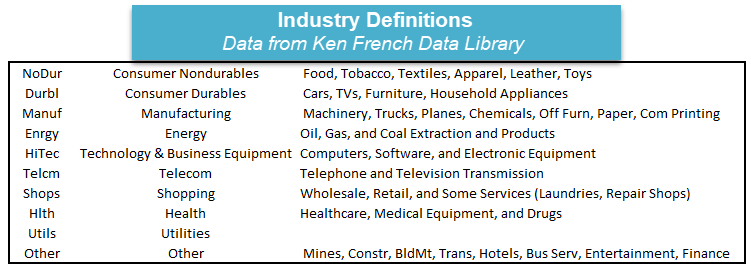

In order to help provide perspective on what we might expect, we have reexamined the sector data that we looked at for our Presidential Election study in November. Recall that this looked at the historical performance of 10 broad domestic equity industry sectors using data pulled from the Ken French Data Library. This is the same Ken French from the famous Farma-French Model. This data was used as it ran from December 1926 through December 2019. A breakdown of what is included in each of the ten industries can be found below:

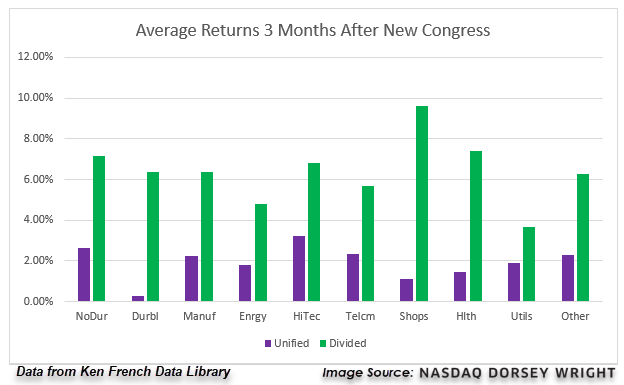

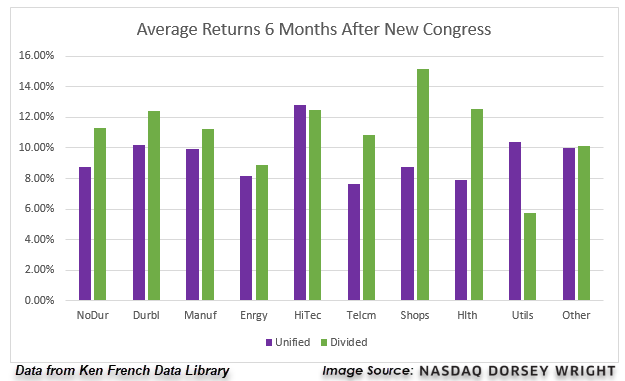

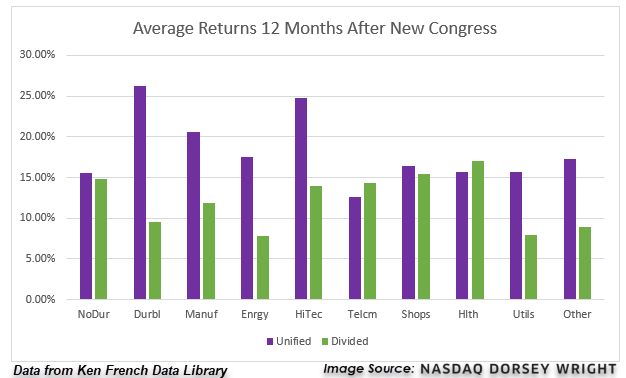

Using these sectors, we then took the average returns of each portfolio over a forward 3-month, 6-month, and 12-month timeframe beginning at the start of each new Congress since 1927. These average returns were then further separated out by whether or not we had unification or division among the political parties in power of the executive and legislative branches. The results of each industry’s forward returns are below, along with some observations. Note that these industry indices are market-cap weighted and use total return data.

- The first quarter of a new congress sees lower average returns across the board if there is a unified party in power.

- Each of the industry groups still manages to average positive returns in the first three months of unified leadership.

- Durables and Shops show the lowest average returns in unified governments during this timeframe.

- The best performing industry in this timeframe for unified governments is HiTech.

- Returns increase significantly six months after a new congress, with each industry posting an average gain of at least 4% regardless of the political environment.

- The leading sectors of a unified government over a forward 6-month timeframe include HiTech, Utilities, and Durables.

- Healthcare and Telecom are among the lagging sectors.

- The industry breakdown changes substantially 12 months after a new congress, with 7 out of the 10 groups showing higher average forward returns with a unified government than with a divided one.

- Durables and HiTech continue to lead the way for unified governments, with Manufacturing and Energy picking up the pace to also be among the leaders.

- Telecom, Utilities, and Non-durables are the laggards from a 12 month forward return aspect.

It will be interesting to see what this year brings. We appreciate the continued trust and confidence that you have shown in us over the past many years and especially during 2020.

On another note, you might have been surprised over the last few months to call our office and find yourself talking with Mia Eckl or Luke Gerolimatos. We are so pleased to be working with both of them. Mia has been interning as an Administrative Assistant in our office since August 2020 and has been of tremendous support to all of us. She is smart, quick, and happy to help get things done. She graduated from the University of Missouri and majored in Psychology. Mia hopes to enter the world of non-profits in the future and will surely make a big difference wherever she lands. We’ll hang on to her as long as we can.

Luke joined us at White Oak in December. Luke studied History and Education at SUNY Albany. He then pursued a career in Health and Human Services and opened a business specializing in Vocational Rehabilitation that enabled persons with mental or physical disabilities an opportunity for useful employment within our community. Luke later transitioned to a financial career, obtaining various insurance and financial licenses, including Long Term Care and Medicare, while working at Western and Southern Financial Group for the last three years. His expertise in these areas will be a benefit to us and to our clients. Luke currently holds his Series 6 Securities license and plans to sit for his Series 65 exam this month. He will then be a licensed Investment Advisor Representative with White Oak Financial Management, Inc. We are so happy to be working with both Mia and Luke and look forward to introducing them to you personally when you come to visit.