Spring is upon us, and I hope you all are well. Asheville’s recovery continues although the progress is quite variable. Last fall’s storm was primarily a wind/tree event for some, a devasting flooding event for others. Those communities that experienced flooding will take much longer to recover. Thanks to all of you who have checked in with us over the last five months. White Oak is back to normal and focused on what matters most – helping our clients navigate the ever-changing markets.

As with the storm, the results of the election and recent news events are viewed quite differently among different people. Leaving most of the politics aside, let me offer some perspectives on the market’s recent behavior, what drives market performance over long periods of time, and how particular aspects of Washington news may influence the markets in the future.

Some investors perceive a significant increase in market volatility since the election. Let’s look at some data. The VIX is an index that measures market volatility – higher numbers mean more daily volatility (the long-term average is about 18). On November 5th, the VIX was 20.49 – somewhat above average. The VIX got as low as 12.77 on December 5th, as high as 27.62 on December 18th, and closed at 19.63 on Friday. Presidential elections typically bring about a certain amount of uncertainty, and it is not surprising to see some increased market volatility in response to that uncertainty. However, the VIX does not reflect excessive or increasing volatility over the past few months.

Similarly, while there have been some big up days and unsettling down days in the markets since the election, this chart shows a market that has gone mostly sideways since then. The S&P 500 has traded between 5,800 at its lows to just under 6,200 at its highs – a range of roughly 7%. This trading range seems quite consistent with what the VIX is telling us – there is a good bit of uncertainty around economic conditions as the overall market is mostly directionless over the past several months.

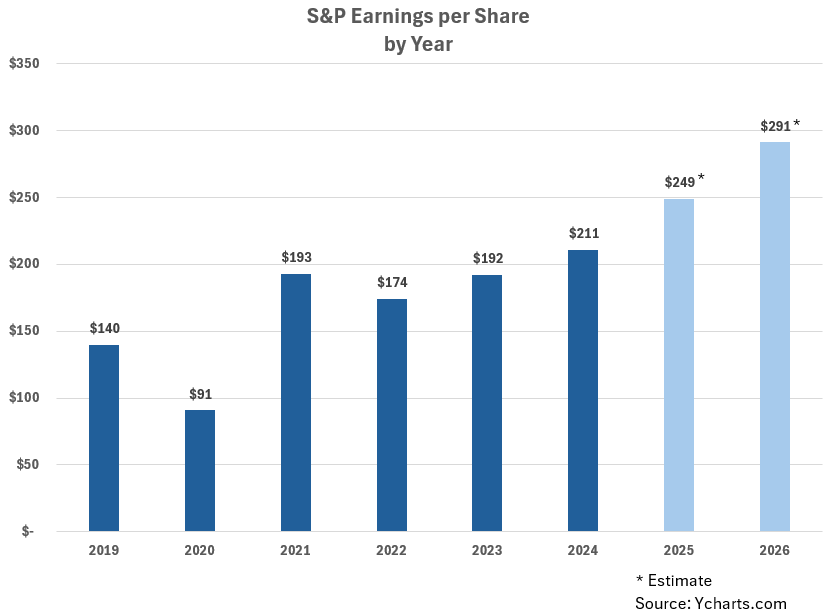

As I have said many times in the past, long-term market moves are driven by corporate profits and large publicly-traded companies have gotten very good at navigating within a variety of economic conditions – conditions that may be the result of presidential policies or those arising from other economic forces. This chart displays the summation of earnings per share of the companies that make up the S&P 500 index. As you can see, in 2019 pre-pandemic earnings were $140 per share. The 2020 pandemic resulted in a substantial decline in earnings, followed by a rebound in 2021. An earnings decline in 2022 (think inflationary pressures) was followed by another rebound in 2023, and then an almost 10% increase in 2024. Projections for the future suggest an increase to $249 per share this year and another increase in 2026 to $291. These future projections come from various analysts’ projections and are current as of February 20, 2025.

Whether these projections become reality depends in part on fiscal policies of the current administration. Some policies can be implemented through executive action (think tariffs, certain budget cuts, and regulatory reform), while others require Congressional action (think the extension of the current tax code). Some policies can increase the likelihood of favorable operating conditions for corporate America. Extending the 2017 tax code is one which would be supportive as would loosening some of the regulatory hurdles put in place during the Biden administration. Thoughtful identification/elimination of waste and fraud within the budget could also help by reducing the deficit and related borrowing costs of the Federal government.

Tariffs, on the other hand, could become a headwind to economic growth and in turn a drag on corporate profitability. Many economists believe tariffs are nothing more than another tax on consumers, either directly through increased costs passed on by companies hit by the tariffs, or to a reduction in overall economic activity resulting from companies changing their behaviors. Some of the recent market volatility seems to be linked to news about the size of the proposed tariffs and a belief by certain investors and traders that economic activity will slow. Will it slow enough to put the U.S. into recession? The consensus among many economists is that it will NOT push the U.S. into recession but could slow the economy. What is perhaps more worrisome is that proposed tariff policies may tip some of our trading partners (Canada, Mexico, and Europe in particular) into recession. Such a recession outside is the U.S. is likely to be felt inside the U.S. and could further reduce economic growth.

Some economists also suggest that the administration’s policy proposal of embedding tariffs into the Federal budget could potentially make tariffs a permanent source of budgetary revenue, which could create a significant new risk to the U.S. budget. If over time the new tariffs result in major changes to global trading patterns, then the U.S. could be open to revenue shortfalls if tariff revenue falls. Such an outcome could lead to increasing taxes on both individuals and corporations – an outcome which could negatively impact economic growth.

At this time, it is unclear which tariffs, and their size, may be put in place. Some point out that the tariffs employed during President Trump’s first administration were not problematic for the economy. That is true. However, the tariffs were put in place at the same time as the 2017 tax cuts were implemented. Those tax cuts were very supportive of economic growth – more than enough to blunt any negative impacts by the tariffs. That situation does not exist now. Yes, the 2017 tax cuts may be extended, however, the extension is not likely to have the same effect as new policy. Therefore, whatever tariffs are implemented this year or next may prove troublesome for the economy this time around. We won’t know until we get a clearer picture of the specific tariffs imposed.

Bottom line? As I said above and in previous writings, the large companies that form the core of most portfolios are very good at figuring out ways to make money and to grow their businesses. Nothing has changed my thinking with respect to that belief.

If you have questions or would like to chat, please get in touch!