As we all continue to navigate these turbulent times, it may be helpful to periodically refocus on why we invest in equity markets and what drives equity markets higher.

When we buy stock in a company, we are buying an ownership stake in that company. That ownership stake gives us the right to participate in the growth and profitability of that company along with other shareholders.

While investors routinely experience market volatility that is the result of political instability, elections, geo-political dramas and now a pandemic, the long-term trajectory of the market follows corporate profitability and growth. For investors (not day-traders), it is this long-term growth in corporate profits that provides the reason to put up with daily/weekly/monthly market volatility. We’re not investing for next week; we’re investing for 3 years, or 5 years, or even 20+ years from now.

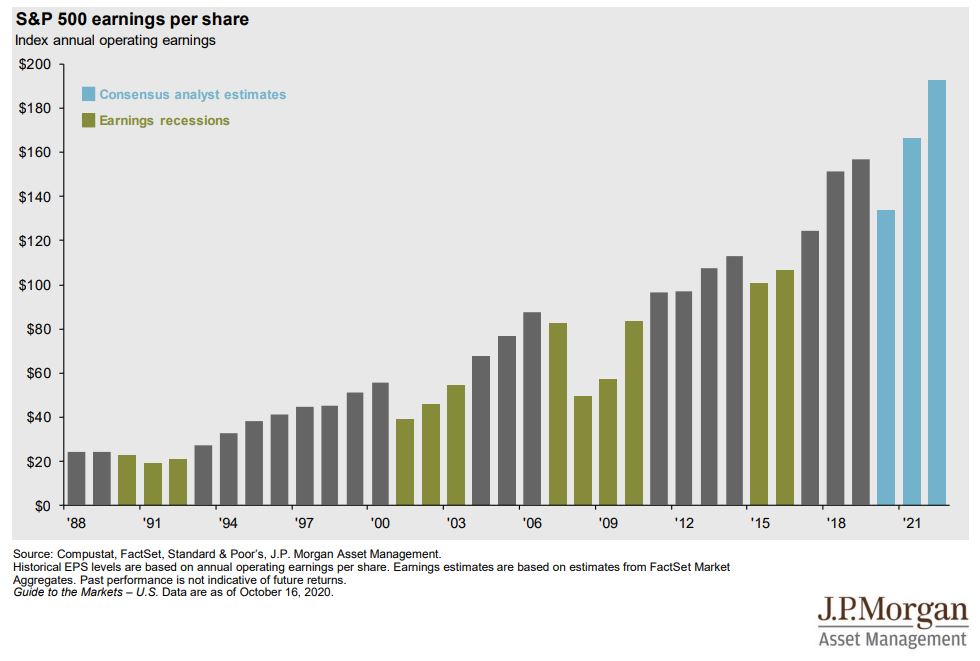

Here is a chart showing S&P 500 earnings per share from 1988 through 2019, with analysts’ estimates for 2020 through 2022 (blue bars). (Earnings per share is calculated by adding up all of the profit from all S&P 500 companies and then dividing by the total number of shares of stock across all those companies.)

In the late 1980s, total S&P 500 earnings per share amounted to a bit more than $20. Analysts’ estimates are that by 2022, total earnings per share will approach $200 – an almost ten-fold increase. Despite a pullback in 2020 earnings compared with 2019, earnings growth is expected to return in 2021 and 2022, and at a trajectory that looks similar to those of the past.

Also notice that earnings for 2020 are expected to come in higher than 2016. Yes, the pandemic has hurt corporate earnings, but the scale of the reduction matters. It’s not like the pandemic is pushing overall profits back to the levels during the 2008/2009 financial crisis or before. As I have said in previous emails, corporations have learned from past mistakes and for the most part, are very good at navigating change.

It would not surprise me to see volatility pick up over the coming weeks, even with the VIX (volatility index) currently at levels that are a good bit higher than average. But such volatility is a price investors have to pay to benefit from stock ownership. Keep that long-term focus ever-present in your mind!

If you have questions or would like to chat, please let me know.