If you happened across a news show or website today, you likely saw breaking news about oil prices crashing. Here are a few that I saw today:

Oil crashes….price goes negative (CNN)

Oil prices plummet (New York Times)

Oil drops below $0, signaling an extreme collapse in demand (Washington Post)

Barrel prices plunge to below zero as coronavirus collapses demand (Fox News)

Oil costs less than zero after Monday’s skid (Wall Street Journal)

These are not from fringe publications. Instead these headlines are from newspapers and websites that hold themselves out as the epitome of a media operating to the highest standards of journalism. Alas, that is not the case. As you may have gathered from previous emails, I am losing my patience with organizations like these that continually use hyperbole to get people to watch, read, or click their headlines. These organizations obviously care more about advertising dollars than the ideals of accurate and honest journalism.

To understand what’s going on with these headlines, we need a short primer on how crude oil and other commodities are bought and sold around the world. Big oil refiners and oil producers do not use Amazon to buy and sell their product; instead oil is traded on exchanges (like stock exchanges) through something called a futures contract. One contract for West Texas Crude Oil represents 1,000 barrels of oil being delivered in Cushing, Oklahoma on a specific day in the future. Each month has a contract, so I could buy one futures contract for oil for October 2020 delivery at a certain price…let’s say $30 per barrel. If I owned that contract, then I could sell it to someone else between now and the delivery date for some other price or I could take delivery of that oil in October and pay $30 per barrel. A contract represents 1,000 barrels of oil to be delivered on a certain date and at a certain price.

So what was really happening today? The May 2020 oil futures contract expires tomorrow and if you own one of those contracts, you must pay for the oil and take delivery of those 1,000 barrels tomorrow in Cushing, OK. Not surprisingly, there are people out there who are not in the oil producing or refining business who try to make money trading oil futures contracts. And when I say trading, I mean that they have no intention of taking delivery of any oil, ever. These traders will buy contracts at a particular price and then try to sell them at a higher price before the contract expires. Today, some traders got caught and had to unload their contracts at ridiculously low prices (even below zero) because they couldn’t take delivery of the oil. (If you violate the terms of the contract, you can be taken to court and you will likely lose your ability to trade in the future.)

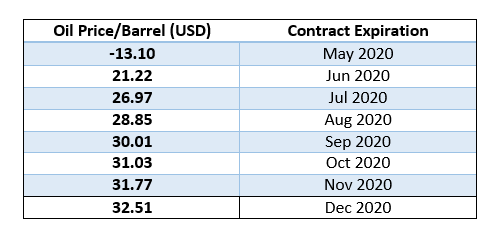

If the news media really cared about informing people then they could have shown you a chart like the one below. (The oil prices shown below were the closing prices on the Nymex Exchange at the end of the day today.)

Today was one of those bizarre anomalies that does not mean anything except to those few traders involved and obviously to the news media. The news media pumped this story out all day long hoping to get people worried enough to keep coming back for more news. Today meant nothing in the grand scheme of oil prices or what oil prices say about the health of our economy. The prices you see in the chart above, especially the longer-dated contracts, are little changed from what they were on Friday of last week or a week ago or a month ago. And as I said in a previous email, current oil prices have much more to do with the Saudi/Russia price war than anything else. Yet the media is conflating oil prices and coronavirus into one continuous scary headline.

What should you do? From an investing viewpoint nothing. From a viewpoint of sanity during these crazy times…turn off the TV…be skeptical of the headlines you see…complain to the media outlets you frequent.

If you have questions or would like to chat, please let me know.