I hope you all are well, and that spring is springing in your neighborhood. Asheville is coming along in its recovery. Except for those hard-hit flooded areas of the region, things are mostly back to normal.

What’s not normal were the market drops on Thursday and Friday. Across those two days, the S&P 500 dropped more than 10% and is now down roughly 17% from the February highs. And while we experienced declines over the past few weeks as the administration talked about coming tariffs, the acceleration of those declines are likely the result of the policy announced after the market closed Wednesday afternoon. The administration’s tariffs are much higher and much more onerous than most people expected and in fact are derived in a way that is quite puzzling. The administration talked about employing reciprocal tariffs (ex: Germany puts a 10% tariff on US cars sold in Germany so the US should have a 10% tariff on German cars sold in the US). However, the unveiled policy did not look anything like that and instead just focused on the trade imbalance between the US and other countries. Rather than trying to explain the situation myself, I’ll direct you to a short video and then a more detailed article. Both of these are from CNBC, the business channel and website that I trust for accuracy.

- Video: https://www.cnbc.com/video/2025/04/03/economists-question-how-tariffs-were-calculated-by-trump-administration.html

- Article: https://www.cnbc.com/2025/04/04/trumps-tariff-rates-for-other-countries-larger-than-word-trade-data.html

Not surprisingly, the question I’m hearing from clients over the past few days is whether we need to do something in response to the market’s recent moves. In December 2023, I wrote an email that discussed one of the indicators I use to monitor stress in the markets. If you missed that email or don’t remember the contents, you can review it here: https://whiteoakfinancialmanagement.com/2023/12/06/monitoring-stress/.

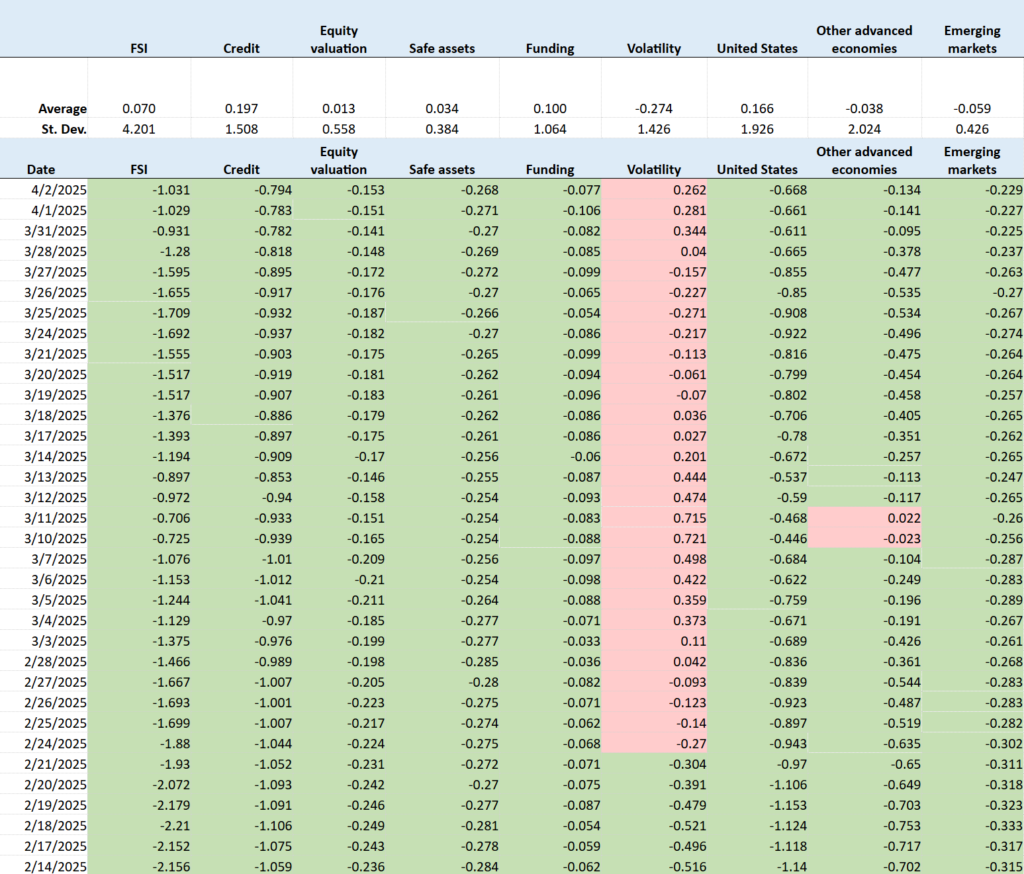

As I said in that email, it is important to be able to distinguish between the normal, sometimes uncomfortable, gyrations of the markets and events like the 2008/09 financial crisis, or the Dot.com bust of the early 2000s. One way I do that is to pay attention to whether market stress, like we’re experiencing today, is bleeding into other parts of the financial system. Below is a screenshot of the indicator showing the readings over the past month and a half. (Green shading indicates below average stress; pink shading indicates above average stress.)

What you will notice is that, except for volatility, the other sectors of the financial system (credit, equity valuation, safe assets, and funding) indicate below average levels of stress. The reason is that overall our economy is in pretty good shape and, even with the market volatility of late, the other parts of the financial system are functioning without elevated stress. What you see in this table now is very different than how it looked in August 2007, a year before the worst of the financial crisis.

What I see in this table looks much more like what I was seeing at the outset of the pandemic. The market fell dramatically in the early days of the pandemic but then turned around quite quickly and recovered within a few months. Will that happen this time? It could. If the administration negotiates deals with various countries and rolls back these tariffs before damaging the overall economy, then I would expect the market to rebound. We’ll have to wait and see if that happens.

In the meantime, I will be following this indicator and others to monitor whether the market’s elevated stress is spreading into other parts of the financial system. As long as it does not, then I think it’s best to hang on and not react to a market that is already down 17% from recent highs.

If you have questions or would like to chat, please let me know.

Take care!