I hope you are all well. Asheville is, thankfully, enjoying a beautiful spring and the recovery efforts are continuing. Much of the region is back to normal and visitors are encouraged to return to enjoy our mountains.

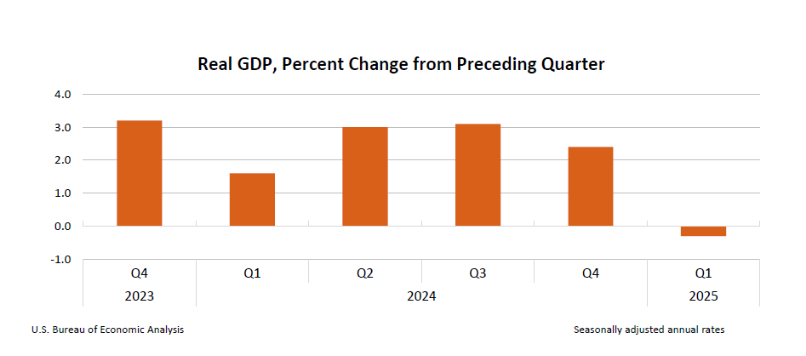

News out yesterday: first quarter GDP (Gross Domestic Product) contracted at an annualized rate of 0.3%. Many economists and analysts were expecting an expansion of GDP by 0.4%. Not only was Q1 negative, it was also significantly lower than the last three quarters of 2024. Below are quarterly GDP over the past six quarters.

Any decline in GDP leads to talk of the “R” word – recession. A recession is commonly defined as two consecutive quarters of declining GDP, so all eyes are on what is happening in the current quarter. Are we in the early stages of a recession?

Before we make that call, it’s important to understand how the US Bureau of Economic Analysis measures GDP. Certain measurements such as Consumer Spending add to GDP, while others such as Imports subtract from GDP. Here is a chart showing the primary contributions to GDP for Q1 2025.

Consumer spending was positive in Q1 2025, growing at a rate of 1.8%, although that was far lower than the 4% growth we experienced in Q4 2024. Government spending and investments declined by 1.4%, with most of that decline coming from national defense.

The other two components that were most impactful in Q1 were Investment and Imports. Investment grew by 21.9% in Q1 2025, a number that is more than twice as much as any quarter in the last two years. Consumer/government spending and investments add to GDP.

Imports in Q1 grew at a rate of 41.3%, but imports subtract from GDP. And the import number was large enough to push the overall measure of GDP into negative territory.

What should we take away from this report? Because the factors having the greatest impact on Q1 GDP were not ones typically associated with recessions, I am not ready to say that we are in the early stages of a recession. Instead, the outsized investment (business equipment) and the import numbers were likely the result of Corporate America doing what Corporate America does – finding ways to make money in all kinds of environments. When the administration turned to tariffs just after Inauguration Day, Corporate America got busy trying to insulate itself from a regime of tariffs that were not, and still are not, well understood. Corporate America imported significantly more products to put into inventory ahead of the tariffs. Here’s one example: in late March 2025, Apple reportedly shipped 1.5 million iPhones and related products by cargo planes from India and China to avoid the tariffs scheduled to take effect on April 5th.

Corporate American also made significant investments in equipment in Q1 2025. This is also likely the result of front-running the tariffs to purchase components required for their operations.

What happens next? If increasing imports subtract from GDP, then declining imports will add to GDP. In the coming quarters, companies are less likely to be able to use the import more strategy a second or third time, so it would not surprise me to see declining imports in future quarters. And in fact, we are already beginning to see signs of such, with the Port of Los Angeles announcing an expected 35% decline in shipments for next week.

While declining imports would boost GDP, if import reductions result in fewer products on shelves, and if the products on shelves are priced higher because of tariffs, that combination could result in falling consumer spending. And falling consumer spending could easily tip the economy into a recession.

Uncertainty, and there is a lot of uncertainty out there, is not good for the economy; it is not good for Corporate America; and it is not good for the markets. And while I don’t think we are destined to fall into recession in the coming quarters, it is important that the administration do what is required to reduce uncertainty with respect to its trade policies. When consumers and corporations change behaviors because of uncertainty, even if that just means doing nothing and waiting, that can become quite problematic for continuing economic growth that is supportive to growth in corporate profits.

If you have questions or would like to chat, please get in touch.