I hope you all enjoyed the holiday season, and the new year is off to a great start. I know it’s been cold everywhere. Over the weekend, Asheville got its first snow of the season with low temperatures in the single digits. Brrrrrr!

The market has been on a long road back up from the lows in October 2022 and on Friday, the S&P 500 closed at a new all-time high of 4,818. The last time the market was above 4,800 was intraday on January 4, 2022 – over 2 years ago. Bear markets (down more than 20% from highs) are not all that uncommon, happening on average once every 5 years or so. This bear market took a bit longer than average to reach its low (10+ months) and somewhat longer than average to fully recover (14+ months).

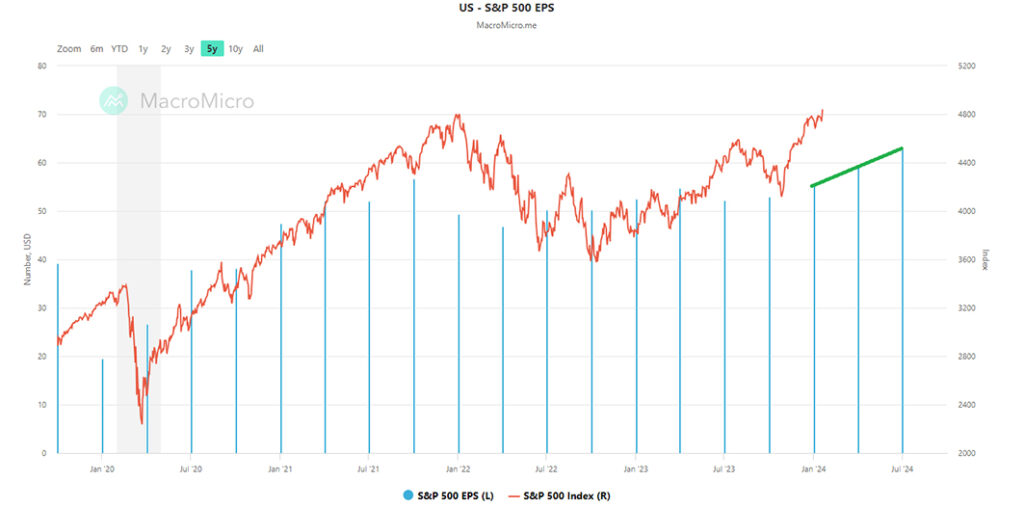

The good news the market is telling us is that corporate earnings, which fell in 2022, may be back on the rise. Here is a chart that displays quarterly S&P 500 earnings per share over the past 5 years (blue bars/right scale) with the S&P 500 index (red line/left scale). Please note the scales for the left and right axes are different and sized in such a way that you can more easily see the story.

The story of this chart is that as earnings go up, the market goes up and vice versa. S&P 500 earnings hit a high in the 3rd quarter of 2021, then declined in the 4th quarter (Jan 2022) and the following quarter. Since Jul 2022, S&P 500 earnings have been in a narrow range. The last 3 blue bars in the series (Jan – Jul 2024) are estimates for earnings for Q4 2023 and the first 2 quarters of 2024. While the market does not move in lock-step with earnings, the market’s direction (up, down, or sideways) does correspond to earnings. If the earnings estimates displayed (those last 3 bars) come in as expected and continue higher into the end of 2024 and then into 2025, then the market should follow along and move higher from here.

Despite this promising news, when markets hit new highs, all manner of pundits show up in the media, often making dire calls about the market being too high and frothy and predicting coming disasters. My response to questions about such predictions:

- The market stress indicators I monitor suggest lower than average levels of stress in the market now and these stress levels have been declining over the past few months, not rising.

- Bear markets happen on average once every 5 years or so. Based on that history, a new one starting later this year is unlikely.

- Watch corporate earnings. Market disasters do not happen when corporate earnings are solid and growing.

I’m not saying we are beginning another year like 2017 or 2021 when the market went straight up. Even with earnings growth, there are likely to be bumps along the way. Beyond the political and geo-political dramas swirling, bumps could result from changes in interest rates (those short-term rates controlled by the Federal Reserve as well as longer-term rates determined by the market), whether inflation keeps coming down, and whether the job market holds up in the coming year or so.

If you have questions or would like to chat, please let me know.

Stay warm!