I hope you are all well and enjoying springtime.

The market hit all-time highs at the end of March and since then has traded lower, reaching a decline of roughly 5.5% last week. This morning the market is down again, although still higher than last week’s low. The move this morning is the result of news that first quarter economic growth (GDP) came in at 1.6%, which was below the expected rate of 2.4%, and below the Q4 2023 figure of 3.4%.

Declining economic growth can be troubling. However, the way we measure economic growth is not always well-aligned to our expectations. Therefore, it is important to dig into the specifics of today’s number to understand whether something is going on in the economy that should cause concern.

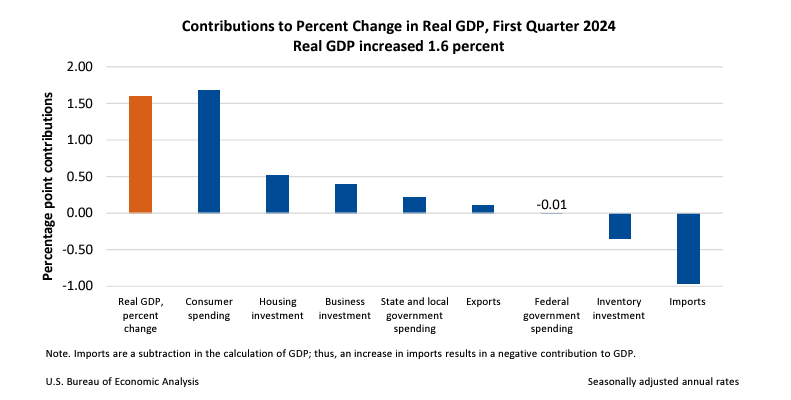

And the answer – not so much. Yes, GDP growth slowed in Q1, but the three areas that contributed most to that slowing do not necessarily spell trouble. The areas were increasing imports, decreasing inventories, and lower government spending at the local, state, and national levels. While consumer spending remained strong, there was also some deceleration, but that may not be a bad thing either since elevated consumer spending tends to be a headwind to a further decline in inflation. The graph below shows the contributions to GDP from eight different metrics.

And what about the market? From the lows last October through the end of March, the market (the S&P 500) was up over 21% – that’s a very strong move. So it’s not particularly surprising that the market has sold off over the last few weeks. A 5% move down from recent highs is quite common, occurring on average once or twice a year. These times of consolidation can be healthy for the market, giving corporate earnings a chance to catch up with market valuations.

As always, I am monitoring quite a few market stress indicators. Most of these indicators show average to below average levels of stress, suggesting that this recent volatility is not the start of something new. We are also in the middle of earnings season and are learning how corporations are managing the current times and whether they are seeing trends that could be problematic for their ability to generate profits. So far, earnings reports are a bit of a mixed bag, but I have not heard anything that causes elevated concern. If that changes over the coming weeks and if market stress rises and starts to spread to other sectors of the financial system, then my opinion would change.

If you have questions or would like to talk, please let me know.

Happy Spring!