I hope you are all well and enjoying a beautiful spring. Asheville is blooming and the longer and warmer days are a welcome change to the gray, rainy winter.

Over the past year, the news of several bank failures and other banks requiring capital injections have surfaced memories of the 2008/09 financial crisis. That’s not particularly surprising given the initial responses to that crisis (zero-percent interest rates) were firmly entrenched until a few years ago.

The process of normalizing interest rates coupled with aggressive hikes to combat inflation began in March 2022 and concluded in July 2023. Many analysts expect the next action by the Federal Reserve to be an interest rate cut sometime this summer. However, given the strength of the US economy and jobs market, whether the Fed stays put, cuts rates, or even increases rates, remains to be seen.

For banks, higher interest rates typically translate into higher revenue and income. However, for a few banks, the aggressiveness of the interest rate increases exerted pressure on their capital positions. When banks take deposits from customers, those deposits can be loaned back out to other customers, or invested in very safe, high-quality bonds (Treasuries or mortgage-backed bonds). The problem for some banks is that from 2010 through 2020, they bought long-dated bonds that paid relatively little interest. When interest rates spiked, those long-dated bonds went down in value – the longer the duration of the bond, the more its value declined. This decrease in the value of a bank’s bond portfolio was reflected in the bank’s capital levels, causing some depositors to worry and move their accounts, which further impacted capital, and a vicious cycle was started.

I would never minimize the significance of bank problems or failures, although it is important to be able to put some perspective on the current situation compared with the 2008/09 financial crisis. Let’s look at some charts that provide this perspective.

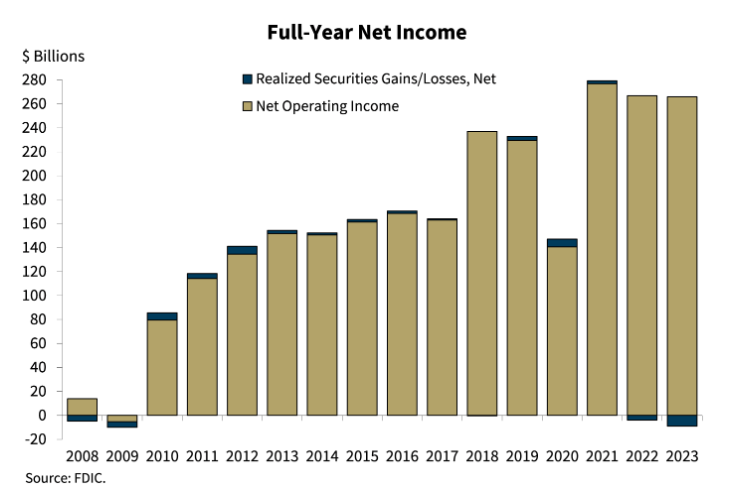

This first chart displays the net full-year operating income for the US banking industry (gold bar) with the net realized gains/losses of their security portfolios (blue bar).

The comparison of 2023 to 2008 & 2009 is dramatic. US bank operating income is many times higher than income in 2008 and losses in 2009. Further, considering the relative size of the gains/losses of the securities portfolio compared to net income, it is not unreasonable to expect that most banks can manage the risk.

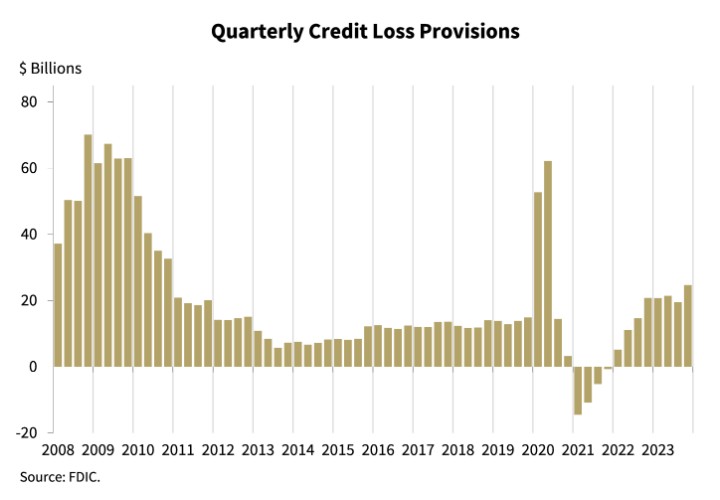

This next chart shows quarterly loss provisions by US banks. Loss provisions are assets a bank puts aside to cover losses that may arise because of something going on in the economy. For example, you can see significant increases in loss provisions in the first two quarters of 2020 – the start of the pandemic. In the 4th quarter of 2020 and throughout much of 2021, the negative bars show banks releasing these set-asides as it became clear that assistance from the government during the pandemic helped companies stay in business and continue to make loan payments.

Comparing the loss provisions in 2023 to those in 2008 – 2010 shows levels that are much lower, albeit somewhat higher than those seen in 2014 for example. But it seems quite appropriate for banks in 2023 to recognize that for some customers, especially those who might need to refinance their loans, a higher interest rate environment might prove problematic for those customers. Somewhat higher levels of loss provisions therefore seem prudent.

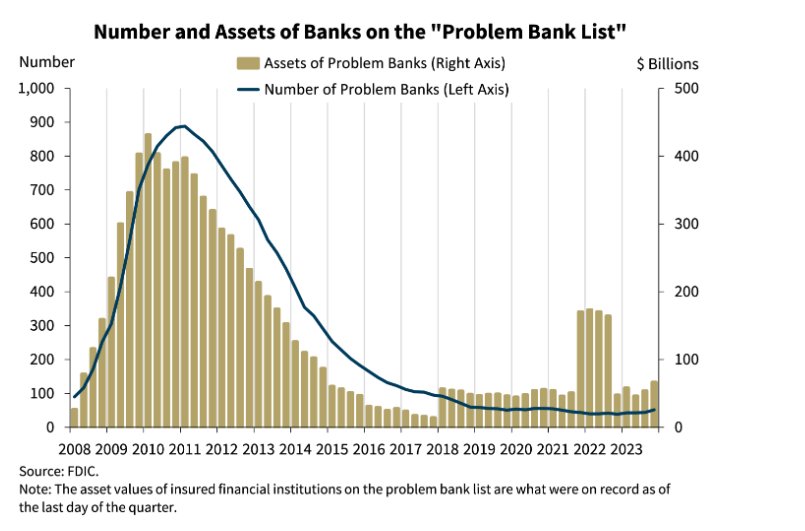

Lastly, this chart shows the number of banks and the associated assets on the FDIC’s Problem Bank List.

Again, comparing 2023 to 2008/2009 shows a very different situation, with many fewer banks on the list in 2023 and the assets held by those problematic banks at much lower levels. In fact, the number of problem banks on the list at the end of 2023 represents just 1.1 percent of all US banks, which is at the low end of the normal range for non-crisis periods. And while the spike in problem assets is apparent in 2022, the banks associated with most of those problems have been resolved. Silicon Valley Bank, Signature Bank, and First Republic were all taken over by the FDIC in the first half of 2023.*

As we are all well-aware, the health of the US banking industry is critical to the health of the US economy and vice versa. And while increasing interest rates have put pressure on aspects of bank operations, the current economic conditions are not creating levels of stress anything like those experienced during the 2008/09 financial crisis.

If you have questions or would like to chat, please let me know.

Have a great day!