A comment I hear from clients, friends, and others on a fairly consistent basis relates to a disconnect between the market’s performance over the past month or so and their perception of where we are in our journey through this viral pandemic. I often hear questions like:

Why is the market up so much if most of the economy is still shut down?

Shouldn’t the market be a lot lower with all this bad news (unemployment, bankruptcies, etc.)?

There’s still a lot of bad news to come, won’t the market react badly to that?

It’s going to take a lot longer to get things going again…there won’t be a vaccine for a year. How can the market be up so much?

Despite what many of the talking heads on TV say, no one knows exactly why the market behaves as it does. But let me offer some thoughts on what I see as three phases of our roller coaster ride that began on February 21st.

Phase 1: The S&P 500 hit an all-time high on February 20th, despite seeing weeks of images of temporary hospitals full of patients in Wuhan, China. I don’t remember any one bit of news that tipped the scale, but as I mentioned in a previous email, I think the market was looking for a reason for trade lower. The market was up over 13% since September of 2019 without a pullback, so we were probably overdue for one. Beginning on February 21st, volatility picked up and the market began moving lower, while still behaving fairly normally. High quality names held up pretty well and the defensive nature of most clients’ portfolios behaved as I would have expected. By early March with the market down 10-12%, client portfolios were down too, but only about half that of the S&P 500. Again about what I would have expected.

Phase 2: As we moved into the 2nd week of March, the news about the virus significantly worsened and volatility jumped even higher. In the weeks leading up to the March 23rd low, we experienced a sell-off like no other. Everything was selling off – high quality, low quality; things with exposure to the shut-downs (airlines, cruise ships, retail) as well as things with little exposure to the shut-downs (tech, biotech, pharma). The oil price war was also confusing market participants and intensifying the sell-off. It was during this phase that some people were selling out of fear, while others were selling because of margin calls. There was also a tremendous amount of short-selling. The market’s behavior was quite irrational.

Phase 3: The market hit a low on March 23rd and since then has traded mostly higher, with the S&P 500 higher by almost 29% off that low. This third phase is the one that has many investors scratching their heads.

How can the market be up so much, with so much uncertainty about the future?

The answer to that question I believe is two-fold. First, I think the market overshot to the downside. There was so much irrational selling and short-selling that few if any stocks were trading on anything remotely related to future profitability. In the days after the March 23rd low, the market gained more than 10%, with the gains impacting most stocks, regardless of what the company did. It was a reflexive move higher off of a very low number.

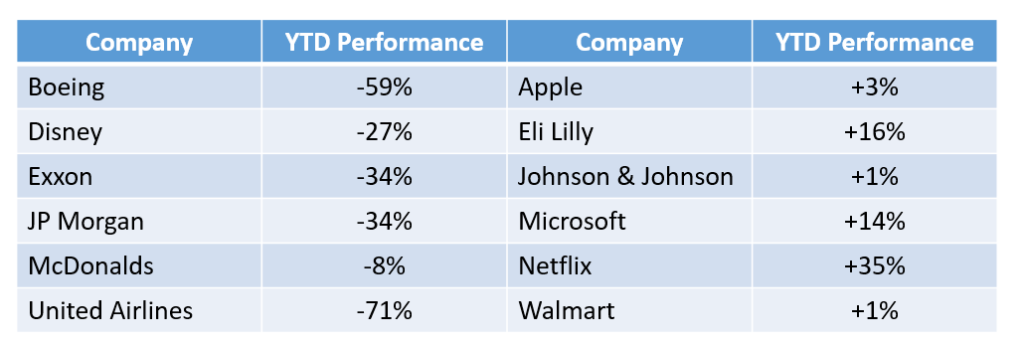

But since that time, we’re seeing rationality come back into the market and a divergence across difference sectors of the market. Companies that are likely to be negatively impacted by the virus and the shutdown are still well-below their highs, while companies that have benefited from the pandemic and the shutdown have recovered a lot. Take a look at the year-to-date performance of a sampling of companies.

Even though the S&P 500 is up a lot off the March 23rd low, it’s not equally distributed across all companies. It’s easy to understand why Boeing and United Airlines are still down more than 50%; the big banks like JP Morgan may have to stomach some bad loans and lower interest rates pressure profits; and Exxon is feeling the effects of the oil price war. On the other hand, Netflix is doing very well because of all the new subscribers added during the lockdown; Eli Lilly and J&J have potential products that can fight the virus; and while Apple may sell fewer iPhones during the current quarter, people will continue to buy Apple’s products for many years to come.

There are still many unknowns out there and I won’t try to predict when we get “back to normal” or when the market gets back to all-time highs. But I am very much encouraged that rationality seems to be returning to the markets. I am not particularly concerned about how much the market has recovered because I can see the market trying to price what happens over the next few quarters and into next year. It may take a while for United Airlines to get back to normal and its price reflects that. At the same time, it makes sense for Apple and Eli Lilly to be priced where they are.

To end this email, I’d like to share an outlook that you’ve not likely heard before given the media’s propensity to serve up negativity. The link is to an interview with Jeremy Siegel, Professor of Finance, Wharton Business School. Dr. Siegel is often criticized as a perma-bull, but he’s right more than he’s wrong and that’s what really matters. Plus hearing a positive viewpoint based on solid economic fundamentals is a nice way to start the weekend.