As we head toward year-end, it is easy to chalk up 2020 to a crazy year where nothing made sense. Aspects of that might be true for living through pandemic-induced lockdowns, re-openings, and a Presidential election. But since the early days of the initial market sell-off (late February through mid-March), the market is largely behaving in ways that make sense.

In previous emails, I have pointed out that the indexes that we see reported in the news media do not always align with our view of the economy. But that is the fault of the index (how it is constructed), not because you are missing something.

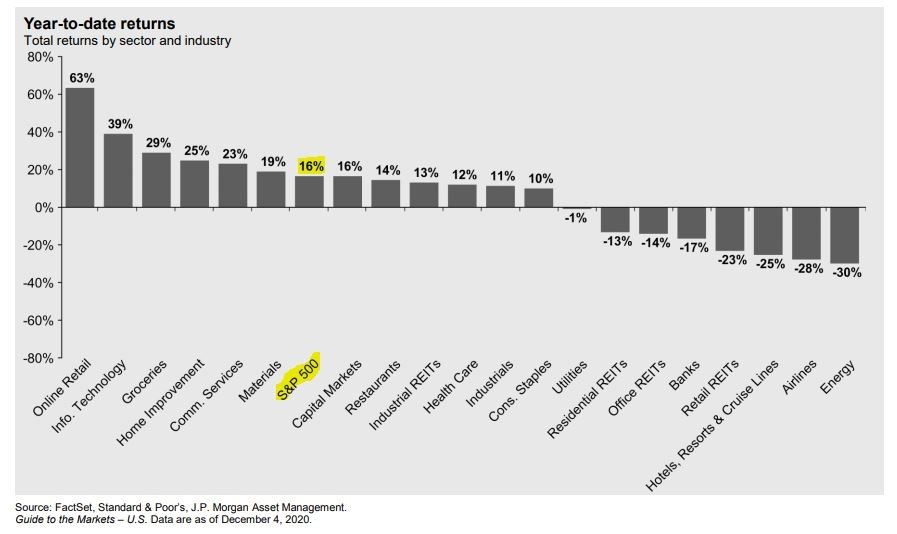

Below is a chart showing year-to-date returns by sector and industry through last Friday.

What industries have been the hardest hit? Hotels, resorts, cruise lines; airlines; and energy (down 25%, 28% & 30% respectively). Are these not the ones that you expect to be down the most?

What industries have done the best? Online retail; technology; and groceries (up 63%, 39% and 29% respectively). Are these not the ones that you would expect to be up the most?

You might scratch your head at seeing that restaurants are up 14% for the year. But this number likely does not include your neighborhood bistro or your favorite fine-dining establishment. What restaurants would be included in that number? Right … McDonalds, Domino’s Pizza, and the like. Does a return of 14% for these kinds of restaurants make sense? I think it does.

Here’s a link to a chart I provided in an earlier email. This interactive chart allows you to see the 10 largest companies in each of the sectors of the S&P 500.

With respect to some important housekeeping, I think I have spoken to each of you who had a decision to make about whether to take the Required Minimum Distribution (RMD) from your IRA or Inherited IRA. Just as a reminder, in the early days of the pandemic, Congress made RMDs for 2020 optional. While it has not been the case for all clients, many have chosen not to take the RMD this year – leaving more money inside the IRA to grow and to lower their tax bill for 2020. If you don’t remember having this conversation or want to revisit it, please let me know.

I will also be reviewing capital gains/losses across your taxable accounts and will be in touch prior to year-end if any tax-selling might be beneficial.

If you have questions or would like to chat about any of this, please let me know.

Cheers!!