A recent conversation about a dire prediction by a talking head made me think about the seasonality of the markets. As we head from mid to late summer, the number of experts predicting a coming market downturn seems to be increasing. These experts want to be viewed as insightful sleuths uncovering something profound that the rest of us dullards cannot see. Do not be impressed.

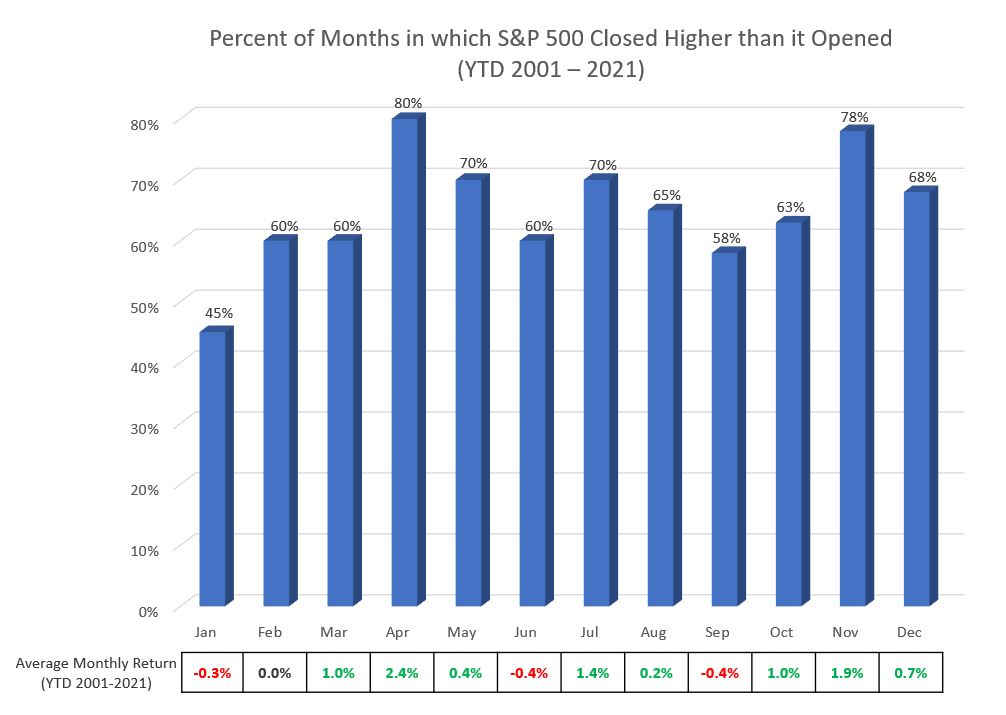

Most market participants that have spent time studying the past are well aware of a seasonality to market returns, with September and October being among the weakest months of the year. The chart below shows the percent of months (over the last 20 years) in which the return of the S&P 500 index closed higher than it opened. Quite the range, isn’t it?

The best 3 months of the year are April, November, and May. The worst months of the year are January, September, then followed by a tie between February, March, and June. Across the bottom of the chart, you can see the average monthly return of each month over the last 20 years. The 3 months with a negative average return are January, June, and September.

Therefore, with the S&P 500 up almost 20% year-to-date it seems like a no-brainer to get on TV and predict a market downturn over the next month or so. We all know that markets go up and markets go down and since we are up a lot over the year and seasonally September and October and weaker months than November and December, voila … let’s make that insightful prediction.

As you probably know, I am not one to make overly specific market predictions. However, I will say that I would not be surprised by a market pullback of 5 – 10% over the coming months. Such occurrences happen on average 3 times per year and we have not had one since last fall. In fact, we had two last fall, one in September and a second one in late October. But as soon as we try to start predicting a pullback, the market may confound us and continue to trudge higher. We’ll just have to wait and see.

Despite the short-term ups and downs of the markets, I feel perfectly comfortable predicting the market will be higher in the future than now. Why? Because the corporations in which we invest are good at growing their profits. And over time, increased profits ultimately lead to higher markets.