Happy Fall, y’all! October begins my favorite time of the year for many reasons which include the weather and market investment opportunities. The third quarter of 2021 is officially in the books, and while it was punctuated by heightened volatility in the final days of trading, the S&P 500 managed to eke out a gain for the quarter. According to The Stock Trader’s Almanac, “September is when leaves and stocks tend to fall on Wall Street. It’s the worst month of all.” This year, September lived up to its unfavorable reputation. The S&P 500 was down about -5.2% for the month, marking the first +5% pullback for the broad market benchmark since October 28, 2020. It’s been a long time coming. This streak of 341 calendar days without a 5% pullback is the longest such stretch since February 5, 2018, which ended a streak of 588 calendar days. Currently the SPX sits at about 4457.

In contrast to our 12 month banner year in 2020, during which our charting and momentum strategies helped us to produce client portfolio returns in the high double digits, 2021 has not been kind to our momentum and trend-following investment strategies, and we have trailed our benchmark by about 10%-15% for most of the year since early February, when we joined many smart money investors and took some profits in our holdings. Our intent was to reinvest in the same asset classes and sectors that were doing so well when the profit-taking began, but alas, the best thing to have bought in March 2021 instead would have been an S&P 500 index fund, as no asset class or sector has held the momentum lead for any decent period of time this year. But, as they say, hindsight is 20/20. Even though the Dow and S&P 500 continued to reach new highs each month, it’s been a slow-rise, low-volatility year until just recently, which makes momentum investing difficult to do successfully. Thankfully, these years are unusual for us. For now, not only does it feel like 2016 all over again, but our returns have also closely mirrored 2016 when our performance lagged our benchmark by about 10% at year end. We hope that our momentum strategies will help us to pull ahead going into this last quarter.

Love, Hate October

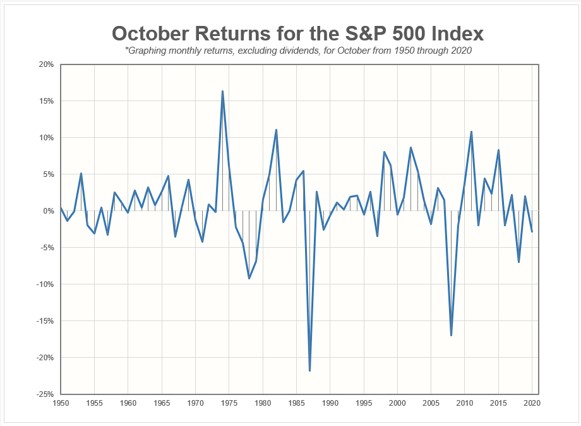

Investors have a longstanding love-hate relationship with the month of October. Some of the more notorious market meltdowns have occurred, or at least escalated, in October, including 1978 (-9%), 1987 (-22%), and 2008 (-17%). And several of the largest one-day market declines, including Black Monday (1987) and Black Tuesday (1929), happened in October. Still, important to note, the S&P 500 (SPX) has had more double-digit gains in October than it has double-digit losses since 1950. In fact, October is often referred to as the “bear killer,” as its end ushers in the beginning of the seasonally strong six months of the year. Like February, September is usually a tough month to maneuver. As we have in the past, we’ve used the common September correction to raise some cash for availability to buy into the equity markets at some expected good sale prices.

While many investors have a decidedly negative outlook on September, they tend to have more of a mixed view of October. Since 2008, October has offered some of the more meaningful buying opportunities of the post-Great Financial Crisis long-term bull market including 2011 and, more recently, in 2015 when the S&P 500 rallied over 8% during the month. Last year, however, the S&P was down just over 2.75%. The worst October since 2008 came just three years ago in 2018 as SPX fell nearly 7%, in keeping with October’s love-hate reputation. Historically speaking, October has been positive more often than not, as the S&P 500 has logged gains in 59% of the Octobers between 1950 and 2020. The average return for the month during this time frame is +0.76%.

As we head into the final stretch of the year, we continue to watch closely for any shifts in the market landscape. Domestic equities and commodities remain first and second, respectively, in the relative strength asset class rankings. Meanwhile, from a sector perspective, market leadership resides in the Energy, Technology, Financial, and Real Estate sectors. From a historical perspective, there is reason to believe that October might offer a more constructive environment than September.

If you have any questions about your portfolio or you would like to become more familiar with our investment process and the tools we use to identify market leadership across and within asset classes, please call us. As always, we appreciate your continued trust and confidence in us and in the systems we use that help us to filter out the noise of the markets.