Happy New Year! I hope you all had a great holiday season and that 2022 is following suit. Too bad the markets are not cooperating.

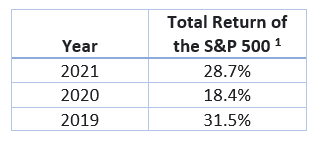

What we have experienced over the last few months reminds me of a song from the early 1970s – Will it Go ‘Round in Circles? Just when we thought the pandemic was ebbing, here comes Omicron to take us back in time to what we were experiencing with the Delta wave last summer. The rancor coming out of Washington is not much different than what we experienced before the 2020 election. And the stock market … is it going around in circles? If you look at the markets over a longer time period, you might say no based on these yearly data.

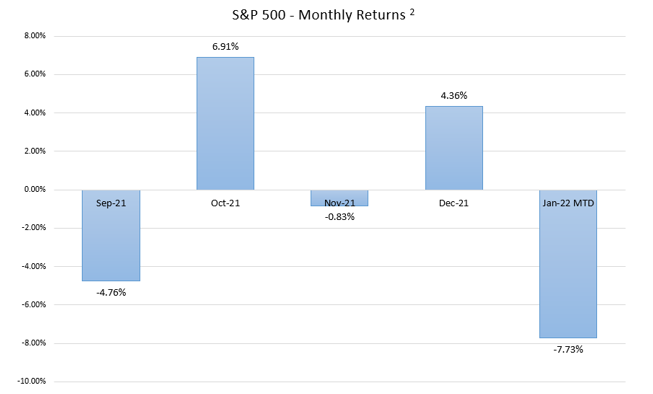

But looking at the S&P 500 over the last several months, we do seem to be going around in circles.

While I am sure no one is particularly surprised by this observation, the question arises – what comes next?

First, it is important to recognize that this recent volatility is quite close to all-time market highs. From mid-October of last year to now, the S&P 500 hit 17 all-time highs. The last 3 (in late December and early January) were between S&P 4,791 and S&P 4,796. The S&P 500 has not been able to break through that 4,800 level. It is not uncommon for markets to surge upwards then pull-back when trying to break into new territories.

Second, as I’ve discussed in previous emails, pullbacks of 5-10% happen on average three times per year, so this most recent pullback of 7.73% is not particularly unusual. Technical indicators suggest the market is oversold so we may be bottoming out and preparing for a new push toward S&P 4,800.

Third, will we make it to new all-time highs? While I don’t expect to see 2022 returns as strong as the last three years, I would expect to see positive returns for the year. Some might ask – how can that be in the face of the continuing pandemic, political unrest, rising inflation and rising interest rates? Corporate profits.

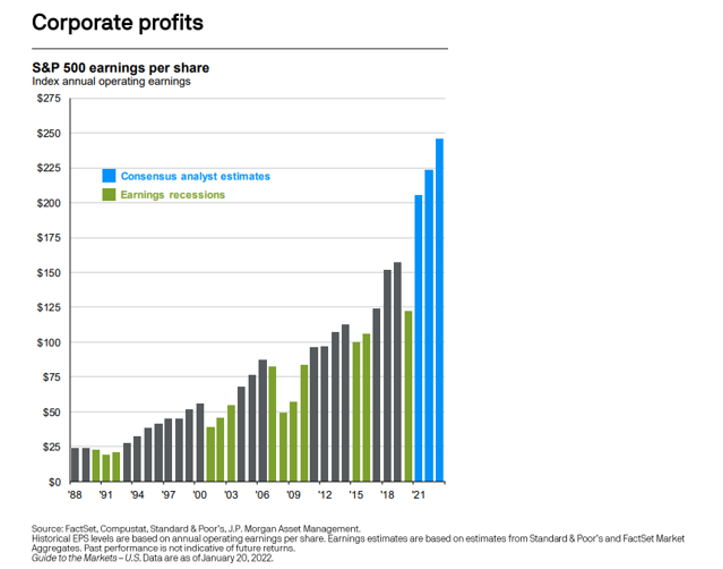

I’ve included this chart in several emails over the past year. It shows the summation of yearly S&P 500 earnings per share going back to 1988.

We can see profit recessions (the green bars) in the early 90s, in the early 2000s and then 2008/2009, then in 2015 & 2016, and finally during the 2020 pandemic. The first blue bar is showing estimated earnings for 2021, which are being reported now. For the most part, earnings reports are coming in-line with these projections.

What can we expect in 2022 and 2023? Higher corporate profits, although it’s clear that the rate of growth – the change from 2021 to 2022 or from 2022 to 2023 – is not nearly as much as the change from 2020 to 2021. But we understand that, some corporate profits were deeply impacted by the pandemic (airlines, movie theaters, cruise lines) and are have rebounded over the last several quarters, while others actually accelerated because of the pandemic. Profit growth may be slow in 2022 and 2023, but analysts are certainly not predicting a profit recession.

Yes, rising interest rates and inflation can negatively impact corporate profits, but we are not likely to see such a torrid rise in interest rates and inflation that results in a profit recession over the next year or two. At the same time, market participants use expected interest rates and inflation in equations that value corporate profits, so some re-pricing of stocks is to be expected. That is one reason I think that 2022 and 2023 annual market returns will be lower than the previous three years, but not negative. As long as corporate profits continue to rise, the market can follow along.

If you have questions or would like to chat, please let me know.

1 Total returns include both price returns AND dividends paid.

2 Monthly returns included in this chart display only price returns.