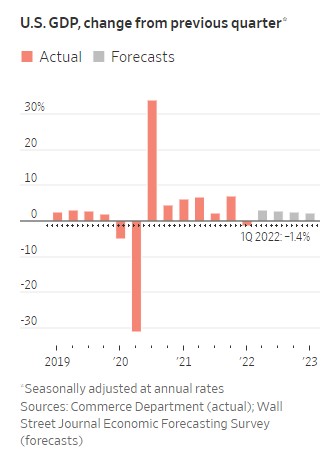

We are all quite accustomed to volatility in the equity markets, but we are also learning that economic growth can be volatile. You will surely read some scary headlines over the next few days about not just slowing growth, but an actual decline in economic activity in the first quarter of the year. This is true: the US economy shrank at a 1.4% annual rate in the first quarter of 2022 as measured by gross domestic product (GDP). GDP was down sharply from a 6.9% annual rate in the fourth quarter of last year.

The graph below shows changes in economic growth (GDP) going back to 2019. It is easy to see the volatility in the numbers resulting from the pandemic; an extreme decline in early 2020, followed by a sharp rebound later in the year. Economic growth was also a good bit stronger in 2021 than in 2019. Going forward forecasts for growth look a lot like 2019.

Beyond the pandemic, this volatility is also a function of how economists measure economic growth. The decline in first quarter GDP was largely the result of three things:

- slower growth of inventory by businesses, compared with the rapid buildup at the end of 2021;

- a widening trade deficit with the US importing far more goods that it was exporting; and

- shrinking government stimulus spending related to the pandemic.

These three factors do not sound particularly troubling and therefore should not cause undo alarm about a coming recession. For me, they seem well inline with what we are seeing in the world and differences between the US and other world economies.

That’s not to sound an unconditional all-clear. There are other issues that could derail economic growth in the future, including the ongoing Russian war on Ukraine, inflation, and rising interest rates. But I’m not ready to predict we’re headed toward certain recession, nor am I ready to make substantive changes to portfolios. The correction that began in early January seems to be following a trajectory like those we’ve experienced in the past. And as I’ve said before, corrections are a process that generally take time to complete. This one is taking longer than others, but that’s not particularly surprising given the confluence of events we’re currently experiencing.

If you have questions or would like to chat about the economy or the markets, please let me know.