There is a lot of talk in the media these day about a recession. We’re in a recession – we’re not in a recession – a recession is coming. So, which one is it?

Technically, a recession in the United States is defined by the National Bureau of Economic Research (NBER) and NOT simply as two successive quarters of declining GDP. The NBER defines a recession as a pronounced, persistent, and pervasive decline in aggregate economic activity. Thus far, the NBER has made no such pronouncement.

While the U.S. has experienced declining Gross Domestic Product (GDP) in the first two quarters of 2022, it is important to reflect on how GDP is measured and what is responsible for what we have observed thus far this year. The chart below shows which sectors of the economy were expanding in Q2 and which were contracting. As was the case in Q1 (see my previous email), changes in inventories and trade factors (imports vs. exports) are responsible for much of the contraction in Q2. These factors are not typically associated with a recession, especially when factors related to consumer and business spending remain strong.

Consumer and business spending, coupled with strong employment data (the U.S. added more than 500,000 jobs last month and the unemployment rate declined to 3.5%), also suggest that the US is not currently experiencing a pronounced, persistent, and pervasive decline in aggregate economic activity.

But what about later this year or next year? What about that inverted yield curve? You have likely heard or read about the inverted yield curve as evidence that we are in a recession, or one is coming. Let’s review for a moment.

What is the yield curve? In most instances, investors require higher payments (yields) for buying longer-dated bonds. Or think of a CD – a bank typically pays you more interest for a CD that matures in 5 years compared to one that matures in 3 or 6 months.

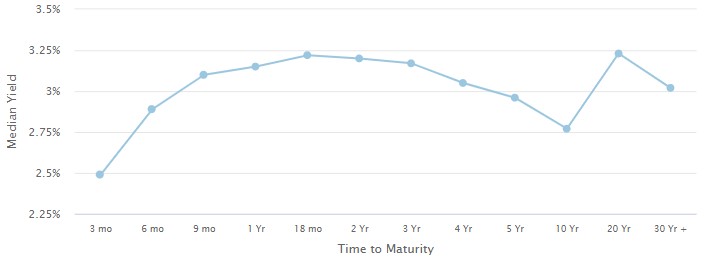

As of today (8/9/2022), the yield curve for U.S. Treasuries looks like this. Clearly, there are some portions of the yield curve that are inverted. For example, an 18-month Treasury yields almost 3.25% whereas a 10-year Treasury yields just 2.75%. That portion of the yield curve is inverted, and some suggest such an inversion is a predictor of a recession in the coming year.

However, economic studies from the Federal Reserve typically compare the 3-month and 10-year Treasuries. That portion of the yield curve is not inverted – the 3-month yield is 2.5% and the 10-year yield is 2.75%.

Further, the Federal Reserve Bank of New York calculated the probabilities of a recession in the following 12 months based on the spread between the 3-month and 10-year Treasuries. As of the end of June 2022, the probability of a recession in the coming year is less than 6%. That’s low! (You can see the probabilities going back to 1960 in two interactive graphs that can be found here: Federal Reserve of New York.)

Other studies from the Federal Reserve and others suggest that while the yield curve can offer some evidence of recessionary conditions in the economy, there are other factors that provide important insight. One dashboard, which monitors the yield curve plus 11 other economic indicators (housing, jobless claims, profit margins, truck shipments, and others) suggests Caution as of the end of July, but not Recession.

This dashboard is interactive and shows how changes in each indicator impact the overall signal. It also includes summary data showing current data compared with those associated with previous recessions. The dashboard can be found here.

For most clients, there is not anything we need to do. Our overarching focus on high-quality, dividend-paying companies should serve us well. Such an approach certainly does not prevent some downdraft in portfolio, but we are benefitting from the market run-up over the last six weeks. The S&P 500 is up roughly 12% since mid-June and client portfolios have tended to follow along.

I’m not ready to declare an all-clear as there are still many headwinds out there, including ongoing inflation and the war on Ukraine. The upcoming mid-term elections are likely to stoke uneasiness as well. But at the same time, I do not think we are in a recession, and I am not convinced that one is on the horizon. As always, it is important to monitor corporate profits – something we do every day – as that is really what the market tends to follow.

Have a great remainder to your summer. If you have questions or would like to chat, please let me know.

Cheers!