I hope you are all enjoying your summer. Travel seems to be back on the agenda for many clients I have spoken with recently, another great sign of the fading effects of the pandemic.

As I have discussed in other writings, the market downturn that began in early 2022 has been remarkable in its length. Historically, market corrections (down at least 10%) and bear markets (down at least 20%) often resolve themselves more quickly than the current one. And while the S&P 500 is up a lot (18.9% YTD), we are still not quite back to the highs of early 2022. I do think we will reach new all-time highs, although I don’t know when that will happen.

For much of 2022 and early 2023, the market faced a number of headwinds:

- the Federal Reserve aggressively raising interest rates;

- the opening of the Russian war with Ukraine and a resulting spike in the price of oil;

- high levels of inflation associated with oil/energy, food, supply bottlenecks, and labor;

- a contraction in earnings of many S&P 500 companies for a variety of reasons; and

- political issues (debt ceiling, et. al.).

Many of those headwinds are fading but I don’t see any fresh tailwinds from factors that might drive new growth. However, just giving corporate America time to operate within an environment with fewer disruptions should allow them to refocus on their businesses and the business of making money for themselves and shareholders (you).

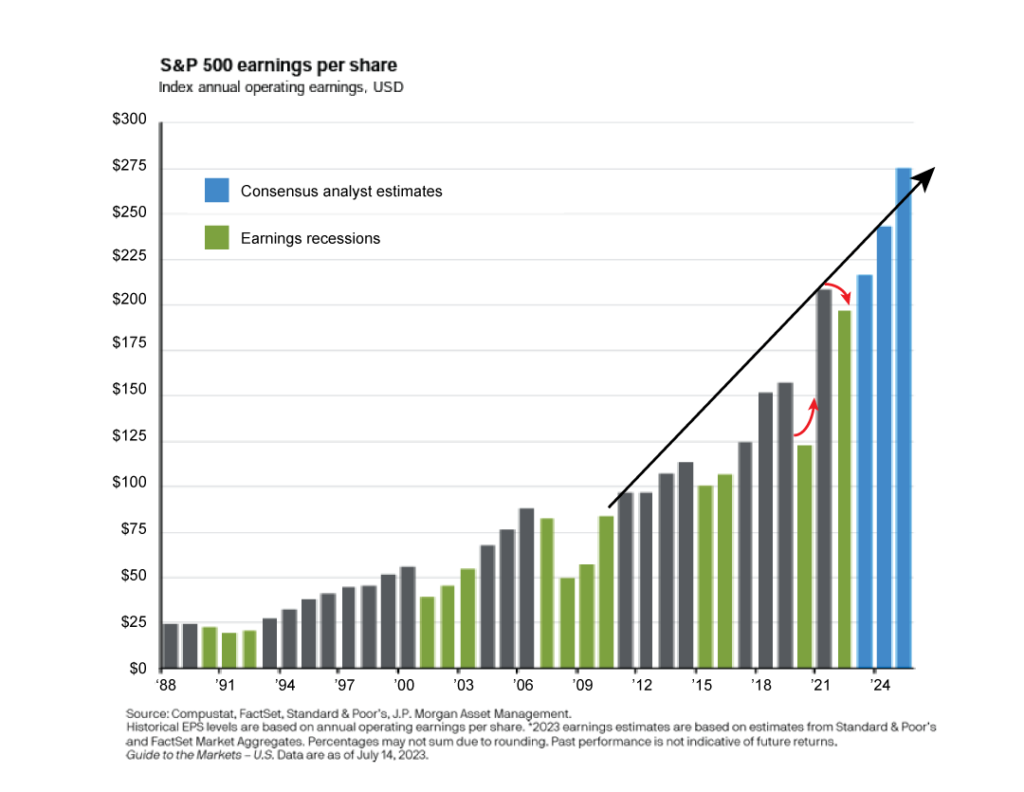

I have used this chart a number of times in the past and it is a good one to revisit because I think it reminds us all that what is most important to long-term market performance is corporate profits (earnings per share). This chart shows the cumulative earnings per share of the S&P 500 companies going back to 1988. The green bars show periods of profit contraction, and the blue bars show analysts’ estimates for annual profits in 2023 through 2025.

It is easy to see the pandemic in the chart: an initial pullback in corporate earnings in 2020, followed by an earning surge in 2021, and then another pullback in 2022. And while you are likely hearing prognosticators on TV talking about a recession this year and another market downturn, the likelihood of that outcome seems to be waning. Most analysts are predicting S&P earnings to be above 2022 and even above the banner year of 2021. And as the arrow suggests (that’s my arrow), 2024 and 2025 projected earnings seem to be heading back to levels of growth aligned with long-term profit growth.

To put a finer point on this idea, the S&P earnings for 2017 were $125 per share. If the analysts are correct and earnings for 2025 come in at $275 per share, that equates to a 10.4% annual growth rate of earnings across those 8 years. And that 10.4% is close to the long-term increase the equity market going back over many, many years. Lots of things can impact the market’s performance over days, weeks and even a year, but the best predictor of long-term market performance is corporate earnings.

If you have questions or would like to chat about this or anything else, please let me know.

Here’s to a smoother ride and more corporate profits ahead. And here’s to you having a great rest of your summer!!

Cheers!